On January 9, Wenye announced December 2023 consolidated revenue of NT$58.806 billion, a monthly decrease of 7.04% and an annual increase of 3.59%, a record high for the same period of the year; fourth quarter consolidated revenue of NT$189.7 billion, a quarterly increase of 13.41% and an annual increase of 20.47%; and full-year consolidated revenue of NT$594.519 billion for 2023, an annual increase of 4.08%, with both fourth quarter and full-year The fourth quarter and full-year revenue both hit record highs.

wps3.jpg

Wenye not only had record revenue in 2023, but also made a large acquisition.

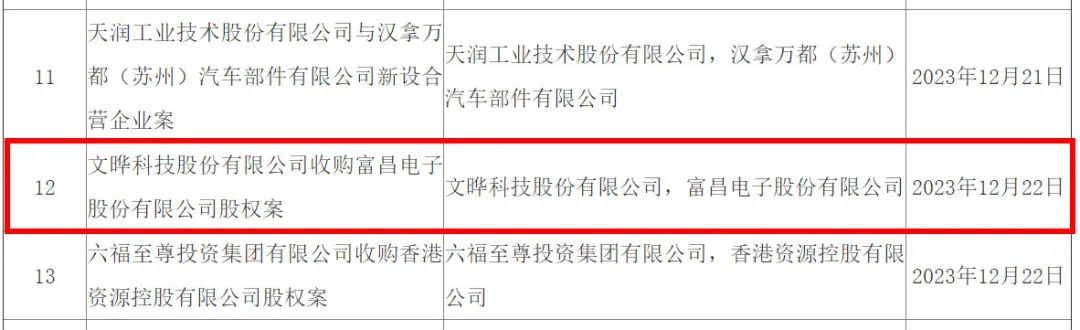

On September 14, 2023, Wenye announced the acquisition of all shares of Canadian channel operator Future Electronics for US$3.8 billion (approximately NT$121.2 billion) in cash, which was approved by the Chinese mainland in December, and is expected to be completed in the first half of 2024 pending review by the competent authorities in other countries.

According to Wenye's Chairman, Mr. Zheng Wenzhong, the acquisition had a number of competitors in the early stages, and the two sides had been talking for about a few months, with less than half a year to finalize the deal. The transaction is expected to be transformational for Wenye Technology, Future Electronics and the overall supply chain ecosystem.

Future Electronics, with its experienced management team and talented employees, is highly complementary to Wenye Technology in terms of product offerings, customer coverage and global presence, and is expected to help Wenye expand its European and American footprints and product lines, which will result in a significant increase in revenue and profitability for Wenye in the coming year.

Currently, Arrow, Avnet and Dalian are the top three semiconductor channel vendors in the global semiconductor channel market, and Wenye is ranked fourth. Future Electronics was founded in 1968, and is not listed, 2022 revenue scale of about 6.1 billion U.S. dollars, about one-third of Wen Ye. Although the revenue scale is not as large as Wenye, Future Electronics' profit in 2022 is about twice as much as Wenye's, and it has zero debt, so its profitability should not be underestimated.

In addition, Wenye has recently conducted a cash capital increase of 135 million shares at an issue price of NT$95 per share. The shareholders of Grand Union and Xiangshuo also participated in the subscription of this cash capital increase.

Last month, Grand Union indicated that its board of directors resolved to subscribe to Wenye's cash capital increase in accordance with the original shareholders' shareholding ratio, with an estimated investment of NT$1.518 billion and a total of 15,977,500 shares, which reduces its shareholding ratio to 14.97%. Since its investment in Wenye, Grand Union has gradually reduced its shareholding ratio. Earlier in November 2023, GCI announced that it had transferred and disposed of 40,000 shares of Wenye in the form of a huge transaction, with a transaction price of NT$126.31 per share and a total transaction amount of NT$5.05 billion. After the completion of the transfer, the shareholding of Dalian University fell to 137,100, retired to the second largest shareholder, the first largest shareholder changed to Xiangshuo.

Xiangshuo also resolved by the board of directors last month to spend NT$1.683 billion to participate in Wenye's cash capital increase case, acquiring approximately 177,000 sheets. After Xiangshuo participates in this capital increase, its shareholding is expected to increase to 197 million shares, however, due to Wenye's capital increase, the shareholding ratio will be slightly reduced to 19.24%. According to the spokesperson of Xiangshuo, Wenye is a 19.28% investor of the Company, and this cash capital increase is mainly for the future growth of operation and enrichment of working capital, as well as improvement of financial structure. Xiangshuo is optimistic about Wenye's operating results in the past few years, and also agrees with the growth of its industrial prospect and strategic layout, which is consistent with the Company's long term investment planning, and therefore resolves to participate in the cash capital increase case.